With increasing life expectancy, it is necessary to implement adjustments to the Public Service Superannuation Fund to ensure pension benefits for future retirees.

- Maximum Retirement Age Changing: The age at which you must leave the public service will increase over the next 10 years.

- Higher Contributions, But No Pay Cut: Your pension contributions will rise, but the Government will cover it, so your take-home pay will not be affected as per the recent salary and wage negotiated pay award agreement.

- Fairer Pension Formula: Pensions will be based on the average salary over the last 10 years.

- Earliest Unreduced Pension Age: The earliest age in which officers can retire and receive an unreduced pension will increase gradually over the next 10 years

- Lump Sum Conversion Factor: This factor will be actuarially assessed at each valuation.

- Governance The Public Service Superannuation Board will have a more formal role in reviewing actuarial valuations and advising on future reforms.

Why it matters:

These changes help protect your pension, ensuring it will still be there when you retire.

There will be no impact on Government workers retiring before March 31, 2027.

The implementation schedule for the increase in the mandatory retirement age is as follows:

Non-Special Groups (NSG) 2025:

from 65 to 68 for Teachers to align with other Non-Special Groups.

| April 1, 2033 – 69 | April 1, 2035 – 70 (NSG) |

Special Groups* (SG):

| April 1, 2025-2026 – 55 | April 1, 2031 - 58 |

| April 1, 2027 - 56 | April 1, 2033 - 59 |

| April 1, 2029 - 57 | April 1, 2035 - 60 |

*Note – Special Groups are our Uniformed Services.

Important, this is not the earliest time that you can retire, but the age of which you must retire from the public service.

Implementation schedule for the increase to contributions is as follows (will be offset by an uplift in salary):

| Non Special Groups (NSG) | Special Groups (SG) |

| 2024 (current) - 8% | 2024 (current) - 9.5% |

| October 2025 - 8.7% | October 2025 - 10.2% |

| April 1, 2026 - 9.3% | April 1, 2026 - 10.8% |

| April 1, 2027 - 10% | April 1, 2027 - 11.5% |

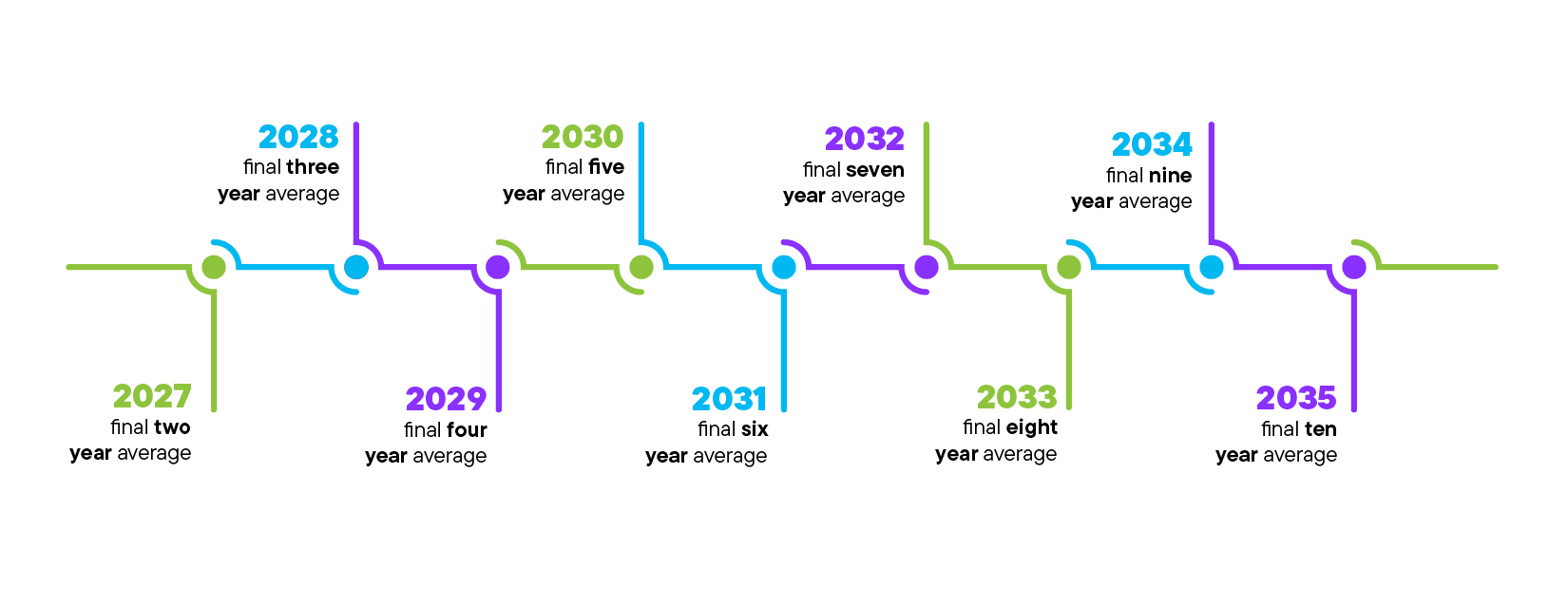

The implementation schedule for the reference wage calculation is as follows:

Additional information provided for clarity following the pre-tabling stakeholder consultation in July:

| Non-Special Groups (NSG): | ||||||

| Year | 2025-2026 | Apr. 1, 2027 - Mar. 31, 2027 | Apr. 1, 2029 - Mar. 31, 2031 | Apr. 1, 2031 - Mar. 31, 2033 | Apr. 1, 2033 - Mar. 31, 2035 | Apr. 1, 2035 Onward |

| Earliest Unreduced Pension Age | 60 | 61 | 62 | 63 | 64 | 65 |

| Earliest Reduced Pension Age | N/A | 60 | 60 | 60 | 60 | 60 |

| Special Group* (SG): | ||||||

| Year | 2025-2026 | Apr. 1, 2027 - Mar. 31, 2027 | Apr. 1, 2029 - Mar. 31, 2031 | Apr. 1, 2031 - Mar. 31, 2033 | Apr. 1, 2033 - Mar. 31, 2035 | Apr. 1, 2035 - Onward |

| Earliest Unreduced Pension Age | 50 | 51 | 52 | 53 | 54 | 55 |

| Earliest Reduced Pension Age | N/A | 50 | 50 | 50 | 50 | 50 |

*Note – Special Groups are our Uniformed Services.

Employees retain the option of drawing their pension at the current earliest retirement age, per the schedule above, although this will be subject to an actuarial reduction in their pension. The amount of the reduction will be set by the Minister of Finance following consultation with the Public Service Superannuation Board and will be based on the actuarial review of the Public Sector Superannuation Fund

Lump sum payments:

From April 1, 2027, lump sum payments will be calculated based upon a conversion factor determined by the actuarial review of the fund. The recommendation of the actuaries will be approved by the Minister of Finance, following consultation with the Public Service Superannuation Board. This one change is estimated to increase the future funding ratio of the fund from 70% in 2065 to 118% in 2065. This increased funding ratio will allow for the consideration of increases in pensions for current and future retirees.

General Questions:

Q1: When will the legislation be changed?

A: Legislation reflecting these proposed changes will be tabled in the House of Assembly during this legislative session, prior to the implementation of changes, which is planned to begin on October 1, 2025.

Q2: How will I know what this means for me personally?

A: We have noted the questions received and have worked with our actuaries to provide illustrative examples and a pension calculator that we will make available for staff to use.

Q3: Can a future government undo these changes?

A: Technically, yes, but this plan is meant to protect pensions long-term and is the best way to ensure the long-term security of your pension. The Government will be briefing the Opposition and hopes to earn their support and ensure that your pension will be there when you retire.

Q4: Were the Unions consulted?

A: Yes, there have been a series of meetings, consultations, and presentations with the Unions over the last two years to ensure the Union executives and members are informed. We have included a schedule with meetings held. Appendix A.

Q5: Who is covered by the PSSF?

A: All public officers, including teachers, uniformed services, and employees of some Public Authorities.

Q6: Why is the Government making changes to the pension system now?

A: Since pensions were introduced 44 years ago, people have been living longer. This means that the Public Service Superannuation Fund is paying out more money for longer periods than it was designed to do. This is depleting the funds, putting future pensions at risk. If there are no changes, the PSSF is expected to be exhausted in 2045. The Government is making these changes, following reviews with unions and independent experts, to ensure that all public officers can have secure pensions for the future.

Q7: Why will the pension be based on a 10-year average instead of your final salary?

A: It’s fairer and more sustainable for the pension’s future security. This change means that pension benefits are better aligned with the contributions made over time. Using a 10-year average (which will be phased in over a 10 year period) is fairer for everyone and helps make all officers’ pensions more sustainable. Bermuda is the only major pension plan in the world that still calculates pension benefits on final salary.

Q8: Will new government employees be under a different pension plan?

A: No. All public officers will continue to be covered under the Public Service Superannuation Plan.

Q9: Is there an official report that shows the pension fund’s status and financial details?

A: Yes. The pension fund is evaluated by an actuary, and a report is produced every three years. These reports are available to the public, the latest was as of 31 March 2023.

Q10: Will transitional arrangements or grandfathering clauses be put in place for long-serving employees?

A: The changes will be implemented in phases, ensuring that long-serving employees are less affected than those just starting in the service.

Q11: Will these changes happen all at once? I’m close to retiring and worried about a big change.

A: No. The government is phasing in the changes over many years to ensure that there are no drastic changes for those close to retirement.

Q12: How will this affect people who are near retirement?

A: The changes are designed to be fair. There will be no impact on those retiring before the phased implementation starts in 2027.

Q13: Will my pension be based on my highest-earning years or just the last 10 years?

A: It will be based on your last 10 years of work, however this change will be phased in over the next 10 years.

Q14: To whom does this apply? (A year ago, there was ‘talk’ that it would not apply to those over a certain age.)

A: The changes apply to all Public Officers, although the impact will depend on your individual circumstances. Public Officers retiring before March 31, 2027 will not be affected.

Q15: Will there be a caveat exempting people presently within the Government with more than 20-30 years' service?

A: The changes apply to all Public Officers, although the impact will depend on your individual circumstances. Public Officers close to retirement will be less impacted

Q16: The current calculation is based on 1.5% per year for every year of service. Will the calculation change from 1.5%?

A: No, this calculation won’t change, but to ensure that the pension fund is sustainable for the future, there will be an actuarial reduction for public officers who elect to receive their pension benefits earlier.

Q17: If the guest worker retires after working for 8 years (vested period), will he/she get the lump sum amount, including the share of Government contributions, before leaving the island? 6 years (not completing the vested period) – will he/she get the lump sum amount of his/her contribution before leaving the island?

A: There are no proposed changes to the law on this topic.

Q18: Can a guaranteed cost-of-living increase be included for retirees in the legislation?

A: The two previous budget statements speak to the fact that once these reforms are passed, the Government will reintroduce cost-of-living increases for retirees that have been frozen since 2014.

Q19: For staff returning to the Government at the age of 57-58. Why are they not able to join the pension plan again?

A: The pension plan has an eight-year vesting period. Therefore, when the retirement age was 65, it would not have allowed sufficient time to become vested in the plan in order to receive a pension. With the current mandatory retirement age increasing over time, the age at which you can join the pension plan will also be increased.

Q20: Will the maximum pension years that they count increase from 40 years?

A: No, this calculation won’t change, but there will be an actuarial reduction for electing to receive pension benefits earlier.

Q21: Would it be correct to assume that the employees’ increased contribution is to “save the fund for the future,” but doesn’t increase a pension amount?

A: Correct. Your pension payment calculation is based on your salary, not your level of contribution.

Q22: Please confirm that the plan will still be a Defined Benefit and not moving towards a Defined

Contribution plan.

A: Yes, this is correct.

Q23: Now that we have recognised that the pension system is at risk, is there any plan to discontinue the borrowing of funds from the pension fund?

A: There is no borrowing of funds from the pension fund. The fund is professionally managed, and there is no borrowing at all.

Q24: Is Customs considered a uniform service?

A: No

Q25: Currently for non-special group staff the minimum eligibility for retirement age is 60. Is this minimum age staying the same or changing as well?

A: This will increase too (over time to 65) although an option for early retirement from 60 will remain. There will be an actuarial reduction for staff that exercise this option. The actuaries have produced illustrative examples in response to the questions received which we will share.

Q26: Will the changes affect former staff receiving pensions?

A: The changes will not affect those who have already retired. However, with these changes, the Fund will be in a position to consider increasing benefits for retirees. These benefits have been frozen since 2014.

Q27: How will the changes affect those who are retiring between now and 2026?

A: There will be no impact on retirement provisions for anyone retiring before March 31, 2027.

Q28: Will the payment percentages be affected? i.e. payout percentages on retirement.

A: Lump sum payments will be changed after March 31, 2027, but the amount of pension benefits that have been accrued will not be impacted.

Q29: Can you advise what exact month/day these changes come into effect in Year 2027?

A: Refer to the charts above.

Q30: What effect will these changes have on Government workers who plan to retire at age 68 in Year 2028?

A: The only change will be the final pension amount would be calculated on the average salary over a 2 or 3 year period depending on the exact date of retirement.

Q31: Would persons retiring in Year 2028 (who are not 70 years old) still get their pension at retirement date OR would they have to wait until they turn 70 years of age?

A: No you will not have to wait until you are 70, the earliest date to receive your pension will be set as stated above (Chart 4)

Q32: Why is there an actuarial reduction for staff choosing to retire at 60? Wouldn’t retiring earlier already reduce lifetime pension compared to retiring at full retirement age due to fewer years of contributions? Is there effectively a penalty for leaving early?

A: There is no penalty for retiring early, however if pension benefits are drawn earlier, that puts additional pressure on the fund. This option, which was added after following the consultation on July 4th, allows those who may wish to draw their benefits early to still have that option, however at a reduced rate.

Q33: If someone retires at 60, could there be savings for the organization (e.g., a new hire starting at a lower scale) that would reduce overall costs? Why would there be a penalty for retiring at 60?

A: There is no penalty, as the accrual of pension benefits will not change, however the time when those benefits will be paid in full will increase over the 10-year period.

Q34: Is there any discussion about reducing lump sum payments for retirees? If so, what would be the rationale and potential impact, considering the calculation based on average salary over 10 years?

A: Lump sum payments will be retained; however, they will change to match the funding status of the fund. This will ensure that lump sum withdrawals do not negatively impact the fund to ensure that it is secure for current and future retirees.

Questions:

Email: ministeroffinance@gov.bm